straight life policy formula

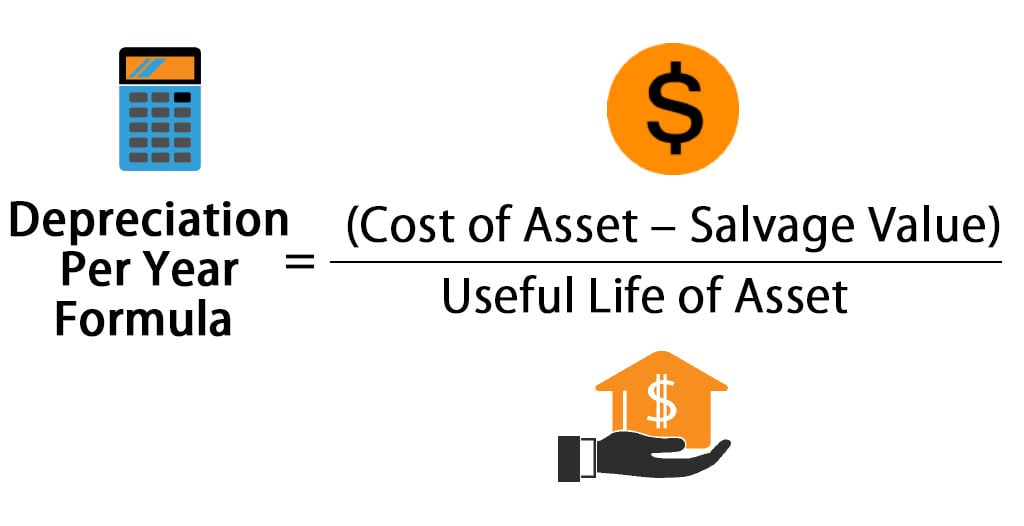

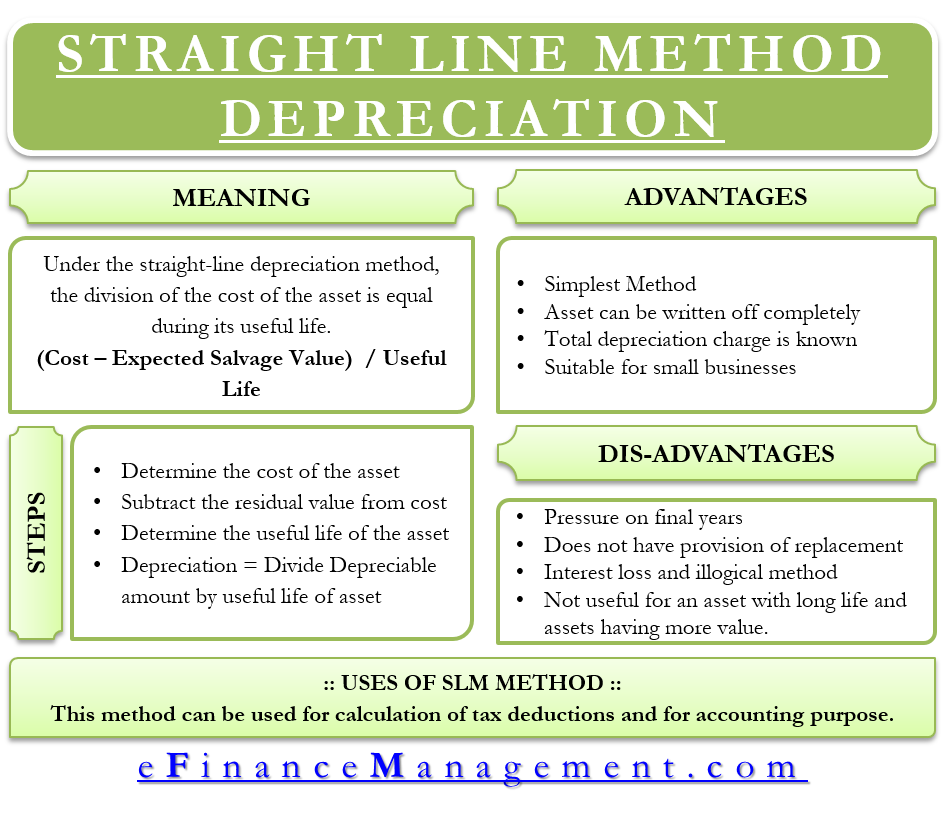

The straight-line depreciation method is one of the most popular depreciation methods used to charge depreciation expenses from fixed assets equally period assets useful life. Divide the product by 12 to calculate your monthly straight life benefit.

Straight Life Insurance New York Life

Start your free trial.

. The Straight Life Option Straight. This is expected to have 5 useful life years. The straight life option is most frequently chosen and forms the baseline for the four A and B options.

Visit to learn more about uniform and non-uniform. You can also talk to a Sun Life advisor. Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the.

A straight life insurance policy often known as whole life insurance. Straight Line Depreciation Formula Guide To Calculate Depreciation It is the most simple kind of one-dimensional motion. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

Melissa Toby age 36 bought a straight-life insurance policy for 80000. This article describes the straight life benefit option. Example of Straight Line Depreciation Method.

Depreciation is calculated based on the fiscal years remaining. Has purchased 2 assets costing 500000 and 700000. The salvage value of asset 1 is 5000 and of asset 2 is 10000.

It is calculated based on the fiscal years remaining. If you select Fiscal in the Depreciation year field the straight line service life depreciation is used. 9 2022 Race Time.

Calculate your annual straight life pension using your pension formula. Straight Life Annuity. A straight life insurance policy often known as whole life insurance has a cash value account.

If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used. It is calculated based on the fiscal year which is defined by the fiscal. ESPN2 Live stream the Japanese Grand Prix on fuboTV.

Every calculation for other payment options. The formula first subtracts the cost of the asset from its salvage. How to Watch Japanese Grand Prix Today.

The straight-line method of depreciation posts the same dollar amount of depreciation each year. Most term life insurance policies offer a level death benefit and premiums for 10 to 30 years though some companies offer coverage for five years and as much as 40 years. A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy.

A straight life insurance policy can also build cash.

Straight Line Persuasion Jordan Belfort

Annuities And Individual Retirement Accounts Ppt Video Online Download

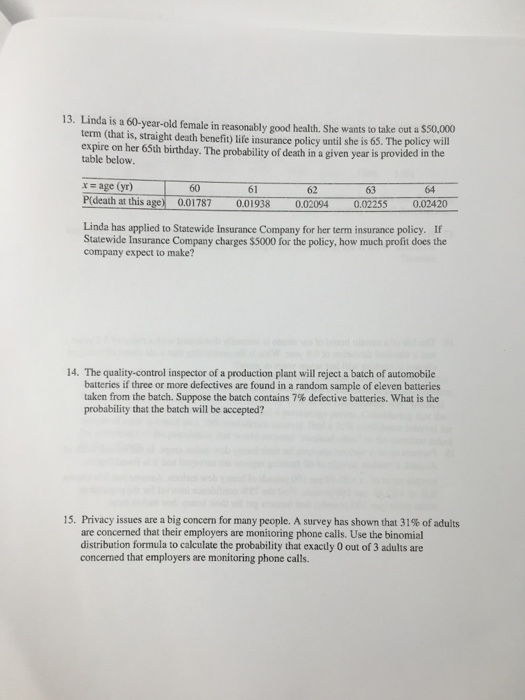

Solved Linda Is A 60 Year Old Female In Reasonably Good Chegg Com

Straight Line Depreciation Method Explained W Full Example

Straight Line Depreciation Formula Calculator Excel Template

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Straight Line Equations Definition Properties Examples

Financial Freedom 10 Step Formula To Achieve It In 2022 Oberlo

What Is Cash Value Life Insurance Smartasset Com

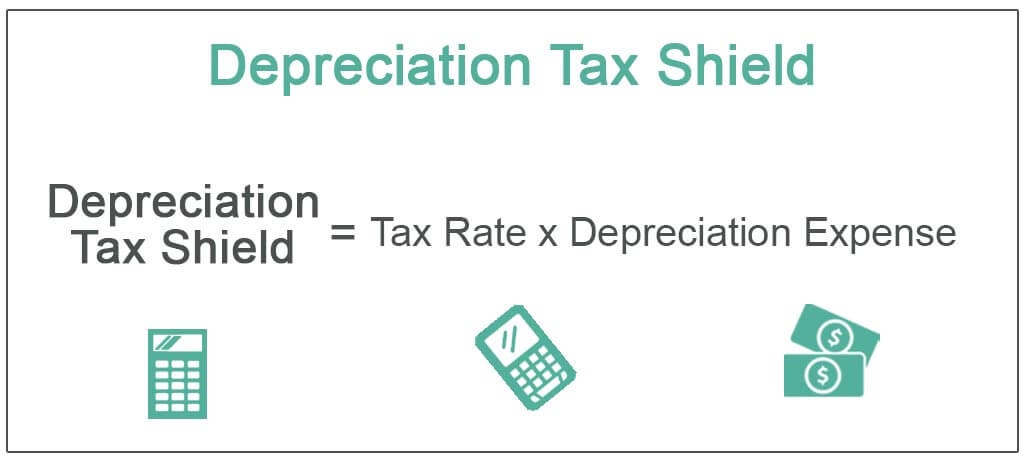

Depreciation Tax Shield Formula Examples How To Calculate

Straight Line Depreciation Formula Guide To Calculate Depreciation

Rent Expense Explained Full Example Of Straight Line Rent

Straight Line Depreciation Efinancemanagement

Life Insurance Calculator How Much Do I Need Prudential Financial

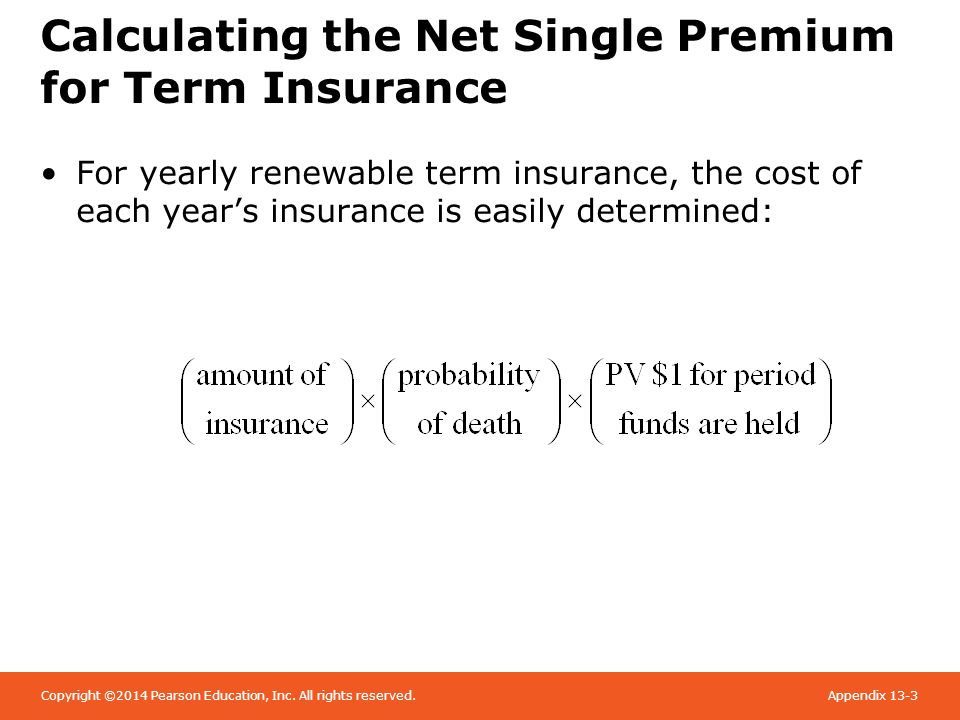

Chapter 13 Appendix Calculation Of Life Insurance Premiums Ppt Download

What Is Straight Life Insurance Valuepenguin

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-5eb88ace64ae40cfa39d93ba9a23f19c.png)